Home » Services » Review of anti-collector services

Review of anti-collection services Anti-collection services - protect yourself from debt collectors Anti-collection services - contact an anti-collection agency Anti-collection agency in Moscow Legal support center will provide the service Anti-collector Discussion: anti-collectors - help or a new loss of money Who are they and should they be trusted Anti-collection services in Moscow Debts to microfinance organizations

“Who are anti-collectors?” – asks a person who hears this word for the first time. Maybe they are fighters against modern debt collectors ? In fact, despite the obvious name, anti-collectors are also interested in the return of debts.

Review of anti-collector services

Officially, the anti-collector profession does not exist. Lawyers specializing in settling debt disputes gave themselves this unusual name. By protecting the rights of borrowers, an anti-collector lawyer can get the loan fine written off, “knock out” credit holidays, or even terminate the loan agreement.

However, this is not a complete list of the services they provide. Many of them successfully defend the interests of borrowers in the courts, negotiate with executive services, and appeal their decisions.

Often they work as collectors, but trying to return funds to individuals who have deposits in banks. In their power:

- terminate the deposit agreement early;

- obtain a refund from an overdue deposit;

- collect mandatory payments from insurance companies.

What you should pay attention to when choosing an anti-collector

When choosing an anti-collection agency, you need to pay special attention to several aspects. Otherwise, you risk paying money for low-quality and ineffective services.

When looking for a reliable anti-collector, pay attention to:

- customer reviews;

- company website and legal address;

- availability of a license for legal activity;

- procedure for drawing up a contract for the provision of services.

It is especially worth taking a closer look at the last point - this will protect you from unexpected expenses, and will indicate in advance the services of the anti-collector, which he undertakes to provide.

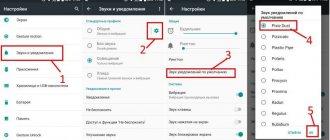

Where can I download the Anticollector program for free on my phone?

Android users can download it from the Play Market. For everyone else, you are welcome to the Yandex.Store. On the shelves there are both daily updated paid versions and a free Anti-Collector for your phone. By the way, the database of numbers for the free version of the program is updated every seven to ten days. Of course, within a week the collectors will easily be able to connect themselves to a new SIM card and start calling you with threats. Therefore, ExpertToo.ru recommends installing a paid application: you will have a 100% guarantee of blocking unnecessary numbers, and it is inexpensive - about 30 rubles...

Amazing! At the moment, the black list of collection numbers includes more than 6 thousand contacts! And this number is constantly growing!

Operating principles of the Russian Anti-Collectors Association

Today, the Association of Russian Anti-Collectors operates on the territory of the Russian Federation. Its members also have special advantages. Firstly, they learn about all changes in legislation in a timely manner and regularly improve their skills. Secondly, all their activities are aimed at improving the quality of anti-debt services.

The Association of Anti-Collection Lawyers provides its members with legal protection of interests before government agencies and the opportunity to participate in changing legislation.

How much do the services of a good anti-collection agency cost?

On average, a consultation costs 1,800 rubles, but there are companies that claim free initial conversations. The participation of an anti-collector in negotiations with a bank costs from 5 thousand rubles. in an hour.

Here is the approximate cost of defending the interests of borrowers:

- 5.5 thousand rubles per month – total debt up to 600 thousand rubles;

- 9.8 thousand rubles per month – total debt up to 1 million rubles;

- 16.8 thousand rubles per month – total debt up to 2 million rubles;

- 33 thousand rubles per month - if your debt is up to 3.5 million rubles;

- 60 thousand rubles per month - if your debt is up to 6 million rubles.

The client usually makes such payment monthly until the contract is terminated.

There are no fixed prices for most anti-collector services. As a rule, there are negotiated rates that directly depend on the volume of work done and the level of complexity of the work.

Some specialists take 20% of the amount saved by the borrower in a banking dispute.

The effectiveness and legality of the Anti-collector application

The program caused a fairly strong reaction, which is natural: its use violates Federal Law No. 230, which outlines the right of the creditor or his representative to contact the debtor. The National Association of Professional Collection Agencies (NAPCA), soon after the appearance of Anti-Collector, filed a complaint with GooglePlay, demanding its removal. Once the application was actually removed from free access, but soon returned in an updated form.

Evgeny Pyatkovsky spoke about his application on the TV program Let Them Talk:

However, the program helps to avoid unwanted calls, that is, it is essentially no different from any other spam blocking program. Collectors can always contact the defaulter in other ways, for example via email. This means that the program cannot be classified as illegal.

Many experts do not take Anti-collector seriously. This is the opinion, for example, of Boris Voronin, director of the National Association of Professional Collection Agencies (NAPCA). According to him, “The number capacity of collection agencies is not limited in any way. A professional agency can have a capacity of 100-500 numbers, and they are updated regularly,” he says. This means that the application is simply not capable of interfering with the work of collection bureaus.

Credit lawyers treat the application with caution. The reason is that using it may be considered an attempt to avoid paying a debt, which is illegal. As a rule, at a specific stage of the dispute between a financial organization and a debtor, the law intervenes in the situation. And if collectors decide that the borrower is hiding from them, they have the right to contact law enforcement organizations to initiate a criminal case, which will aggravate the debtor’s situation. If the debtor does not talk to collectors, he simply will not be able to find out about possible ways to repay the debt.

The application interface is very simple

It must be remembered that the actions of debt collectors are clearly defined by law 230-FZ, and if attempts to convince people to repay a debt go beyond what is permitted, the debtor has every right to file a complaint with a higher authority. In particular, collectors cannot call more than once a day and at prohibited times.

Adviсe

So, when going in search of an anti-collector, you should:

- At least superficially study the market for anti-debt services. If possible, call several companies.

- Inquire about qualifications and experience in financial and civil law.

- Soberly evaluate promises and guarantees.

- Competently draw up contractual relations with the selected company.

- If you need to issue a power of attorney for an anti-collector to represent your interests, you should specify the list of his powers as accurately as possible.

Please note that the services of an anti-collector do not always cost in proportion to his qualifications. When choosing a lawyer, do not judge his connections and capabilities by the high cost of the price list.

How it works

The AntiCollector application software was created in order to save Russian residents from annoying calls from collectors and banks. The developers have compiled a large database, which includes all the numbers of such companies. By installing the application on your phone, you can be sure that you will not receive calls or messages from unwanted individuals.

The difference from a regular blacklist is that you don’t have to enter everything manually. The application will automatically detect a malicious call and reject it.

You can also check the number yourself using the Anti-Collector application (even if it hasn’t called before). If necessary, the black list can be replenished manually.

From time to time, collectors call from different phone numbers, so the creators of the program work to ensure that their database is constantly updated. In order for it to constantly expand, users usually actively help developers. If a call comes from a number that is not on the list, you need to go to the Program Settings. There is an opportunity to write a comment indicating the structure that the claimant represented. When the number can be verified, it will be added to the list.

You need to know this: How many times can collectors call: new law

Anti-collectors:

- Anti-collector services Each of our clients who were visited by bailiffs learned how much anti-collector services cost. But these counterparts turned up too late - you have a chance to resolve the situation. Anti-collection services are in greater demand in practice than it seems. There are many agencies in Moscow that provide legal protection at various rates. In……

- Anti-collector services. Who are they and should they be trusted? The modern debtor has not yet fully understood who the collectors are, when some anti-collectors immediately appear. Having opened the dictionary of the mighty Russian language, we will see that the prefix “anti” means the complete opposite of something/someone. Accordingly, we can assume that anti-collector guys should be the complete opposite of collectors, which means they will play on the side of the debtor…….

- Can anti-collector services help? Government authorities are seriously considering the issue of abolishing collection agencies. In the meantime, the services of anti-collectors are in demand. Is the abolition of collectors the near future? Just recently, the whole country was shocked by the act of a debt collector who threw a Molotov cocktail at the window of a debtor’s apartment. As a result, a small child received burns. Alas, such......

- Anti-collection services - protecting yourself from debt collectors The volume of lending in Russia has grown several times in recent years, and with it the number of debtors. Unable to achieve payment of debts on their own, many banks transferred this work to special collection agencies - debt collectors who, through legal (and not always legal) means, forced defaulters to repay loans. Undoubtedly......

- Anti-collection services in Moscow "AntiCollector" is professional legal assistance in solving debt problems. Anti-collection services include a set of measures to defend the legal rights and interests of the borrower before creditors, collectors, and bailiffs. As part of legal assistance to the borrower, our agency provides: advice on issues of credit debts, opposition to collection agencies, ways to solve the problem of the “debt hole”......

- Discussion: anti-collectors - help or new loss of money? Are you interested in the services offered by so-called anti-collection agencies, but are you afraid that this is another useless waste of money? From our article you will find out whether it is worth contacting anti-collectors and how they work. Who are anti-collectors? An anti-collector is a lawyer who protects debtors from collection agencies. Should immediately......

- Anti-collector services - contact an anti-collection agency Before talking about anti-collectors, it is necessary to clarify who, strictly speaking, such collectors are. Collectors are companies engaged in collecting debts using legal (theoretically, at least) methods. That is, a bank that cannot independently collect borrowers’ debts on issued loans assigns this right to a collection company for a fee. In the West, activities......

- Anti-collection agency in Moscow and other regions: effective solution to debt problems Currently, many people have problems with debts, and the consequences of such problems can be very serious. In order to find the most profitable solution in a timely manner, it is recommended to contact specialists qualified in this industry. For many debtors, an anti-collection agency, where credit lawyers work, is seen as the only way to escape in a difficult situation. Home……

- ALGORITHM OF ANTI-COLLECTOR ACTIONS The entire process includes several stages: The debtor contacts the specialized agency, where he describes the problem to a specialist, who, in turn, will talk about the prospects for solving it. After discussing the nuances, an agreement is concluded and payment is collected. This can be a fixed amount or a percentage of the loan amount. The next step is to issue a power of attorney for the company representative......

Anti-collector program: Don't make the mistake, don't pick up the phone!

Collectors began working under the law limiting the number of contacts with debtors only from 01/01/2017. And even then, only large, law-abiding collection agencies follow it. Many collectors, both before and now, “commit arbitrariness.” To get rid of persistent, almost every minute, calls, the Anti-collector application was invented.

What's the point?

The very first, most famous free Anticollector application for Android smartphones was written by Novosibirsk programmer Evgeny Pyatkovsky in 2014. Then it became paid (for a symbolic price), and a little later many other similar applications appeared.

The work of the Anti-collector application is based on the fact that anyone can enter into the general database of the program the telephone number from which collectors call him (it is correct to say “collectors”). The application is periodically updated, the added numbers add to the list of existing ones, and it becomes impossible to call from these numbers to all phones with the installed program.

A logical question arises - what if someone mistakenly or intentionally adds a number to the database that does not belong to the creditors? In one of the interviews, the creator of the very first Anti-collector application, Evgeniy Pyatkovsky, claimed that he calls all added numbers personally and only after that enters them into the database.

Who needs it?

In most cases, users of the program are satisfied with it. In fact, getting rid of persistent calls that pretty much ruin your life can’t help but make you happy. Moreover, collectors call not only “inveterate” debtors. Sometimes a person is persistently bothered about a loan that he did not take out (an erroneous number in the collectors’ database or the purchase of a SIM card with a number that previously belonged to the debtor), or they are bothered by endless calls to the borrower’s relatives and friends, whose contact numbers he indicated in the loan agreement.

With some reservations, it can be assumed that the Anti-collector program can give time to “rest” from conversations with collectors for debtors who intend to pay off the debt, but are not yet able to do so. At least, this is how some supporters of the program argue their position in discussions on the Internet.

But this advantage of the program can also have another side!

A spoon of tar

The fact is that if a person really intends to pay off a debt, interacting with collectors (collectors who work according to the law, and not “lawless men”), he can agree on a repayment schedule convenient for him, reduce the size of payments, and sometimes receive a discount - a significant reduction amount of debt.

By installing the Anti-collector program on the phone, such debtors, in essence, “bury their heads in the sand,” and collectors, without waiting for a dialogue, can take the case to court. A decision on loans up to 500 thousand rubles is most often made in the form of a court order, which means that the debtor will be able to find out about it either when the order comes to him by mail (in the best case), or from bailiffs, who will definitely not reduce the amount of the debt , but will only increase by the amount of the performance fee.

Anti-collector vs collectors

However, it cannot be said that the Anti-collector program violates the rights of collectors. In addition, collectors, if desired, can use other communication channels - SMS or email.

The law regulating collection activities stipulates the possibility of calling debtors and even sets the maximum number of contacts and their time, but at the same time it is not stated anywhere that the debtor does not have the right to refuse to communicate with collectors.

You can download the application in the most familiar way - by going to the Play Store and typing the name of the program in the search.

Elena TOLCHINA

Subscribe