I've been writing down all my expenses for a year now. I can no longer imagine a life where I lost control of my finances and don’t know how much I saved this month.

To believe in the benefits of recording every penny, you need to see with your own eyes how your lunches in a cafe turn into AirPods in a month and a half. You can also find out that saving 15% of your salary is realistic if you don’t spend it on shopping in the first days and wait for discounts.

I offer solutions that I have personally tested. And also tips that will help you get the most out of them and not become financially paranoid.

Budget: Expense Tracking (Free)

Suitable for almost everyone, because it works like an operating system: it is a tool, not a colorful product with intrusive services.

Pros: + You can customize wallets, categories and tags + Reports in visual charts + There is a difference in expenses compared to last month + You can enter sources of income (salary/freelancing), if there are several of them + No built-in advertising + Dark theme

Cons: – You cannot set a password without the paid version – Overspends are not displayed in any way.

CoinKeeper 2 (free)

There is already a third version with a completely rebuilt logic, but it seems overloaded to me. It's too big a bunch of buttons that you don't want to waste time on. I use CoinKeeper 2 on a regular basis and am satisfied with it.

Pros: + Simple and convenient interface + Visual graphs + Automatic calculation of the total balance if there are different currencies + If a category is close to overspending, it will first be orange, then red.

Cons: – Too many advertisements for your subscription – The free version promotes credit cards.

Money Lover

Multifunctional expense manager from Finsify Technology studio for iPhone. The advantages are an interface that does not require learning, support for Touch ID and Face ID, and the presence of parameters that change the main and additional menus for intuitive control and simplification of some actions.

Recommendations that, although they don’t appear too often, help you stay within your budget deserve special attention.

MoneyViz 3 (free)

Heavy artillery for those who like to thoroughly introduce every detail. It’s also suitable for the average user, but you’ll still have to figure it out at first.

Pros: + Maximum functionality in the free version + You can fine-tune everything to suit yourself: from the data entry process to the appearance of reports + There are tags and you can even enter sellers, which is rarely seen.

Cons: – Slow navigation: expenses are recorded in several windows – Advertising at the bottom burdens the already text-clogged design.

Zen Mani (free)

The application combines the functionality of MoneyViz and the appearance of the Budget. Easy to use and synchronizes with banks.

Which, however, can become a problem.

Pros: + Synchronization with banks even in the free version + There is a list of stores + Unlimited number of subcategories

Cons: – Access to the trial period is given without your knowledge, so you will only get acquainted with the free version after two weeks – Bank algorithms do not always cope with spending categories and can ruin all your statistics – The free version does not have a budget or reports

What does budgeting automation provide?

Content:

Why do you need to automate budget management? This initiative provides a number of benefits:

- Building a budget strategy, that is, priority goals for which the budget should be allocated. Goals are arranged in a hierarchy.

- Budget planning. This includes annual, quarterly, monthly, and weekly planning. This applies to both the incoming and outgoing parts.

- Budget control.

- Budget analysis: which items provide the most income and expenditure, which expenses turned out to be expedient and which were not.

- Budget adjustments in case of force majeure and other circumstances. Flexibility is a mandatory characteristic of a well-structured company budget, because it allows you to quickly make changes if circumstances change.

- Comparison of the budget plan and the final actual budget for the reporting period. Receiving reports becomes possible in real time.

- Simplification and transparency of the process of making, coordinating and approving decisions on budget changes. Centralized management reduces costs and wasted funds.

Automation of the budgeting process helps eliminate losses of funds, increases the transparency of all ongoing business processes affecting the finances of the enterprise, increases the flexibility of the budget, and allows you to obtain comprehensive information about its condition at any time.

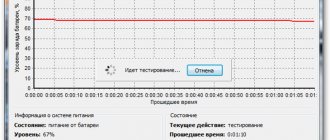

Table in Excel (free)

The most budget and simple option.

If the dry essence of the data you are working with is more important to you, rather than its wrapper, then tables are best suited.

Pros: + Costs in ready-made charts as a percentage + They won’t ask for money even for the full version + Access to the database will be available everywhere.

Cons: – Charts are only divided into three large categories – You cannot enter your wallets – You need to understand the method of operation – Working with the table can be boring and too bureaucratic.

There are alternatives, but they cut off key functionality

I suggest you try it if for some reason the above options don’t suit you. I didn’t use them myself because I lacked details that were important to me specifically.

The convenient Money Flow app does not allow you to set category limits in the free version.

Multifunctional WalletApp prohibits adding more than three accounts. I have seven of them.

Expenses OK as simple as possible. Suitable for children and teenagers who are just starting to manage their money. The reason is that there are no wallets there at all.

You can try all the applications that you see on the cover of the article too. Basically they are no better than each other.

Financial accounting in Android, part 1

Financial accounting applications perform several important functions. Firstly, they allow you to conveniently and quickly record income and expenses. Secondly, with their help you can view statistics for a specified period, and you can extract a lot of useful information from the statistics, which will help reduce costs.

There are many similar applications for Android - the Finance category on Google Play, for the most part, consists of them.

Participants of the first part of the review:

- Financisto

- Financius

- ViZi Budget

- Mofix

- Money Lover

The following applications will also be mentioned:

- Rubbishmoney

- Sea of Money

- Monefy

Financisto

Google Play

Financisto is a personal finance manager. It has a strict and uncomplicated interface. The functions are divided into four tabs. In the first tab, “Accounts,” balance information is available. The user can specify the type of currency for each open account and set the initial balance. Any number of accounts, in almost any currency, is supported.

Financisto synchronizes courses online and automatically converts them into the specified format. For example, account totals are displayed in home currency.

In the “Journal” tab, the user can familiarize himself with all completed operations.

Actually, in this section you can create a transaction (income or expense), specify the recipient, account, project, currency, location, photo of the receipt and other accompanying information on payments.

The “Budgets” category stores funding data. In addition to the account, you can specify a (sub)category, project - in the future, statistics can be segmented using a filter. It is also convenient that money can be transferred to the balance at a specified interval (the function of scheduled and recurring transactions).

Among other things, you should note detailed financial statistics - they are available in the “Reports” tab. As follows from the above, expenses are segmented not only by accounts and categories, but also by periods, projects, recipients, etc. You can display data in the form of graphs and charts, and activate a filter to filter out unnecessary information.

Financisto configures automatic backups on a schedule. Copies of files are stored in the cloud (optional: Dropbox and Google Docs services). Manual import/export of reports in QIF/CSV formats is also possible.

Summary

. Perhaps the main thing in Financisto is detailed and customizable statistics on all operations. The second advantage of the program is automation: budget replenishment and scheduled backups.

At the same time, some of Financisto's complexity may confuse users who only need the most basic operations. For simple transactions, other applications will be useful (see below).

Financius

Google Play

Financius is a financial accounting application that will be of interest to users if complex tools are not required. Here, all operations are simplified, and you can understand the manager’s structure as you go.

To get started, you should create the first transaction and enter the expense amount. After this, you will need to create an account (or several) as a source. When creating an account, the user can select a currency, and exchange rates are synchronized with the server, maintaining current values.

Both expenses and income are divided into tags and categories. Accordingly, in Financius it is convenient to segment transactions by selecting the desired accounts and categories. In the transactions section, in chronological order, information about completed transactions is displayed: date, name, amount and account.

On the “Overview” page, Financius generates statistics, which can be viewed by selecting a reporting period: year, month, week or day. Statistics display expenses, balance, as well as trends - a graph of expenses and income for a specified period. When you click on the top block, information about expenses by category is displayed.

The program supports local and cloud (Google Drive) storage of backups and export of reports in CSV format.

Summary

. Financius is suitable for simple accounting of income and expenses. There are no complex functions like replenishing the budget, setting goals, and automation is not available. Therefore, this product can be recommended purely for personal use.

ViZi Budget

Google Play

ViZi Budget is a multifunctional financial manager for calculating both personal and family expenses. With its help, you can segment transactions, set goals, view statistics in various visual representations, and much more. etc.

The ViZi main page displays the current balance, information about income and expenses. To get started, you need to create accounts and, if necessary, additional categories.

The initial layout of the sections is not very intuitive. Order is established through the application settings; the interface adapts well to the user’s needs. Easily rearrange blocks on the ViZi main screen (current balance, expenses, income, accounts), navigation buttons, charts and other elements. In addition to this, there are widgets that display the balance on the home screen: small (1×1) and standard (3×1).

The initial account is indicated in any convenient currency. In addition, you can set the account expiration date, initial balance and card number. Exchange rates are synchronized with the server.

After adding an account and setting up income and expense categories, transactions are created. Settings familiar from other applications are used here: transaction type (income, expense or transfer), date, account, category and amount. You can create recurring events - that is, replenishment of your account on a schedule. A flaw was discovered in financial transactions: currency conversion is not available in ViZi, so you either have to make all transactions in one currency or convert using a calculator.

Besides categories and accounts, one of the cool features of ViZi is the creation of financial goals. In essence, a goal is the same account that can be replenished by tracking progress on a scale.

A few words about statistics. ViZi allows you not only to view transaction information, but also to track performance. For example, if income or expenses do not correspond to the planned ones, they will be marked with the appropriate “signal” color.

Reports are segmented by income and expenses, balance sheet, budget, categories, and you can also open an annual report. Statistics are presented not only as a graph, but also in a table. The CSV format is available for export, but synchronization is present only in the pro version of ViZi.

Summary

. ViZi Budget offers convenient mechanisms for accounting for finances: accounts, categories, goals, etc. When managing a family budget, statistics presented in graphs and tables will be useful - as a result, it is easy to control what the money was spent on, when the budget runs out, etc. The only thing that complicates working with ViZi is the lack of a currency converter.

Mofix

Google Play

Financial accounting applications typically offer a universal CSV format for export. Accordingly, reports need to be divided into columns for comfortable viewing. Which is not welcome in a situation with a mobile device.

Mofix keeps records of income and expenses in Excel - XLSX format. The statistics file is available for printing and viewing immediately, without requiring unnecessary manipulation of the columns.

The Mofix interface, in general, differs from other representatives of the review: it is minimalistic and does not contain prompts. The first two sections (with the − and + icons) are designed to track expenses and income, respectively. You can specify the category, account and amount, and all this is available in a “one window” mode. When entering the amount, you can first use a financial calculator. The third section is for transferring money from one account to another.

One of the most interesting features of the application is reading and parsing SMS received from the bank. Data from incoming messages is processed through a template and captured in an .xlsx file, along with manually entered transactions. In addition to the SMS templates from the list, you can use custom templates created through a special editor.

The reports created within the program are very modest in visualization - more precisely, it is completely absent, not counting the marking of income and expenses. There are no filters, and the only way to create a selection is to specify a period: day, week, month or year. Apparently, the developers decided not to complicate the reporting, since in the same MS Excel you can customize charts of any type at your discretion.

To synchronize reports, it is easy to connect to Dropbox in Mofix. The file will be available on any device, and statistics can be viewed or changed in the spreadsheet processor.

Summary

. Mofix is, first of all, operational reporting: quick addition of income and expenses, instant export to XLSX. However, in terms of visualization, the statistics still do not reach ViZi and many other participants. The application will also be useful for processing SMS with financial information received from the bank.

Money Lover

Google Play

Money Lover does not frighten you with its complex interface, on the contrary: it seems that this is a “casual” and very simple application. However, as it turned out, there are plenty of interesting functions here, and ML gives a head start to most of the review participants.

The first step is to add an operation. When creating it, you can specify the associated contact, wallet, event and other parameters. The list of categories for expenses and income has already been determined; all you have to do is select the one you want. In addition, it is easy to create your own category and assign an association icon to it.

On the program overview page you can view the statistics or go to the full report. The reports look not only informative, but also beautiful, not far from infographics. The corresponding categories are marked with icons on the diagram - this is clear.

In the left panel, all transactions are grouped by wallet: you can view information about the transactions themselves, debts, trends and categories. Another notable feature of the app accessible from the sidebar is scheduling. Briefly described, Money Lover allows you to define a budget by category, set a financial goal, and also track expenses during your travel/event. In the latter case, all transactions are recorded “on account” of the trip, which is convenient for monitoring current expenses. To switch to travel mode, just toggle the slider in the Money Lover sidebar.

ML also includes various tools related to financial calculations. Among them: currency converter, SMS banking, tip calculator, interest rate, etc. Statistics are exported in CSV and XLS formats (the latter is only in the premium version). In addition, there is a function for uploading to the server and creating a backup copy of data.

The only complaint about the program is the lack of online synchronization of exchange rates, which is why you have to convert from one currency to another manually (by default, outdated data is used).

Summary

. Money Lover has a good interface and rich functionality. The result is one of the strongest applications in its category. ML can be used for various purposes: direct accounting of income and expenses, budget forecasting, for family purposes, maintaining statistics while traveling.

Worthy of attention

Rubbishmoney

Google Play

Drebedengi is a client for synchronization with the online service of the same name; it is intended for joint or personal accounting of finances. It should be noted that without a paid subscription the application will not work fully, and some functions are only available in the browser version.

However, despite the strict connection of “Drebedeneg” to the server, the application is quite convenient for managing expenses and income. You can categorize finances, add accounts, and transfer money from one account to another.

Statistics can be tracked through the “Balance” and “Reports” sections. The latter provide information for the selected period - year, month, week or day, up to an hourly display of transactions performed.

Sea of Money

Google Play

The developers of the “Sea of Money” application accommodated the inexperienced user and simplified the tools as much as possible. However, the necessary functions are present: accounting for income and expenses in the specified currency, viewing statistics. Statistics are only available in the paid version of the application, as are reminders and periodic payments.

For convenience, expenses can be divided into categories, files can be attached to transactions and the location can be indicated. Export features include local and online statistics export in CSV and Dropbox format respectively.

Monefy

Google Play

Monefy is a client that is functionally similar to Financius. It is easy to learn, fortunately the user can refer to the application prompts.

The main feature of Monefy is the quick recording of income (Deposits, Salaries, Savings) and expenses (Food, Health, Nutrition, etc.). To do this, just click on the “+” or “−” icon, enter the amount and indicate the appropriate category. However, in the free version you cannot add your own categories.

It was also noted that although the currency type can be set when creating an account, the list is far from complete. Conversion is also not available.

Account statistics are displayed on the main page. It includes the current balance and information on all expenses and income. You can select the reporting period to display.

Synchronization is carried out through a Dropbox account, backup and export of statistics are available.

Next part: Financial accounting in Android, part 2

Reports in mobile banks will not replace a special application

There are three reasons.

Obviously, there are more sources of spending than one . Automatic charts from the card will not reflect the whole picture, because you can have an additional credit, savings or foreign currency account, and don’t forget about cash.

And every variable needs to be taken into account. When all the money is in one application, it no longer hangs mixed up in your mind.

In “other” Tinkroff hid all the categories that I use most often. The sample turned out to be completely unrepresentative

Expense items are controlled by the bank, not me . AliExpress is listed in “supermarkets”, even if you bought a smartphone there, and in the “various products” and “other” sections there are purchases that I can easily sort manually into other categories.

Transfers to people do not affect the real picture , although they are taken into account in the general flow. It’s easier for me to immediately write down a banana split as “eating out” than to delve into the history of transfers and figure out how much I transferred to a friend for it.

I use CoinKeeper 2 myself, but I recommend choosing between MoneyViz or Budget

Currently, the free version of CoinKeeper is filled with advertising for additional services. I have an old version, which I intentionally do not update. She's happy with it for now.

The Budget application, even in the newest versions, does not have intrusive advertising and has a similar appearance and operating logic to CoinKeeper. A solid leader alternative for anyone who doesn't want to pore over every transaction.

And MoneyViz 3 is the Swiss Army knife of cost control. Tools for recording transactions are customizable, developers allow you to enter store names, and you can add several categories to budgets. The application is best suited for scrupulous users.

If you liked Zen Mani, then keep it as a backup option. Get the main one only when you realize that the free version is worth it. Or decide to buy a full-fledged one for 1990 rubles.

Russian budgeting systems

PlanDesigner

A budget management system that allows you to work with large volumes of data in multi-user mode. Supporting data exchange with programs such as Excel, 1C, MS Project, Parus, Axapta, Navision, SyteLine, SAP/R3, etc.

Intalev: Corporate management

The program, implemented on the 1C:Enterprise 8.3 platform, has a convenient and familiar interface that can be flexibly configured depending on the tasks it performs, without overloading the employee with unnecessary information. The program creates a unified information base of primary data for budgeting and reporting processes. From the received budgets, the user can drill down into any report down to individual deals and operations. It is possible to maintain accounting according to several charts of accounts - RAP, GAAP, IAS or custom standards.

BPlan

Work in the program is built by modeling the budget system, allows you to develop, make changes to the budget model, adjust to changing business conditions, introduce new directions into the already developed budget structure, and analyze data in budgets. The program implements the ability to drill down data into smaller elements.

The model can be built from scratch or use ready-made industry templates supplied with the product.

The program is easy to install, so calling specialists is usually not required. Thanks to its simple interface, you can start working immediately after installation. The developer provides a library of BPlan budget models that can be used to build a budget model for your company. Libraries have text descriptions that make them easier to use.

Among the disadvantages of the program, one can highlight the inability to integrate BPlan with other accounting systems, for example, BPlan does not work with 1C. But budget tables from the program can be printed or transferred to MS Excel. In this case, it is impossible to adjust or change the appearance of reporting documents.

Planior

Works directly in the browser - no need to install anything. Allows you to draw up a budget, upload actual data, analyze budget execution, has ready-made articles and templates for budgets.

Planior integrates with Excel and has the ability to import accounting data from 1C. Security and reliability are ensured by encrypting traffic using the SSL protocol. The service is always available from anywhere.

Control should become a routine that is good for your pockets

I advise you to write down constantly , especially if you often pay in cash. At the very beginning, you don’t want to waste time. But then, from the expenses not entered, itching will appear, as if you didn’t brush your teeth in the morning.

Then comes a clear understanding of where and when you spent. He often got angry with surprise if there was less money in the account than he expected. Now I open the desired month or week and check what kind of hole it is.

Some applications offer synchronization with bank cards and the ability to add receipts. This makes data entry easier, but most often the features are locked behind a paywall.

The graphs reflect the dominant groups that should be given attention. For example, if you spent a lot on travel, check to see if you used taxis too often. After the first month of accounting, you can set budgets by category and check how much you fit into them. And save what you save.

Visual comparison helps you change your lifestyle . I see that I spend more on entertainment than on health and sports, which means I buy fewer games and go to a trainer. These are personal examples that I try to correct. You may have your own, and this identification of priorities motivates you to improve your daily routine.

CoinKeeper

Android iOS

CoinKeeper is an application for those who like to plan or are responsible for the money of the whole family. Here you can set a budget for the month or make it a joint one. A beautiful interface with coins allows you to quickly and easily add transactions, and on the main page you can immediately see your current financial status. As usual, there is a cloud synchronization option. A separate plus is the setting of funds limits for certain categories of spending. In other words, it's a personal finance app that will notify you when you're about to overspend.

The disadvantages of CoinKeeper are the lack of multi-currency accounts and similar operations, as well as the inability to import the database into a separate file or other application. Also, many are confused by the technical imperfections of the web version, which is updated less frequently than the mobile version.

You can't put off recording until the end of the week. Something's sure to go missing

Record your expenses day by day. Next time, maximum. This way you will enter everything and will not forget anything.

Spend cash directly from the store. I used to save receipts, but it was a chore, and some kind of candy bar or one-time trip on the bus was always missed.

Your bank's app stores your purchase history, which you can conveniently copy back to yourself. But don't delay: you may end up with an inexplicable difference even if you insert all the transactions for a week.

Wallet

A classic financial tool for iPhone that displays expenses and income visually using graphs, charts and tables. The application developers from Artezio do not offer any complex formulas for saving and are in no hurry to advise saving and reducing possible expenses.

Quite the opposite - in the infographics displayed, each community member will personally figure out where the money is flowing and how to stop thoughtless spending of money.

You may be interested in: TOP 5 proven applications for iPhone - TV remotes

Tailor the application to suit you so you don’t feel its “weight”

Set it up in advance. Remove unnecessary expense items, add those that are important to you, add wallets, cards, loans and nest eggs. This will speed up and make the whole process clearer.

Divide your meals into at least two categories: store-bought food and food outside the home, such as fast food, cafes and restaurants. It will be more convenient to track your habits.

Don't be afraid to be left without groups that seem necessary. For example, “sports” or “education”. If you don't go to the gym or study on a budget, then make room for “creativity” or “renovation”.

Determine the priority articles for yourself, because free versions of applications often limit their number.

Applications that synchronize with a bank account or SMS from the bank

CoinKeeper

This application attracts attention at first sight. The developers have made a nice colorful interface containing large colored icons. In it you can find statistics that will be displayed in the form of a graph and various color charts, and the ability to send notifications to the lock screen of your device.

There is an automatic budget accounting function that helps predict major future expenses based on statistics. Many may be pleased that there is the possibility of access from different devices. There is a paid and free version of the application.

Zen Mani

Such an application can become your reliable assistant. In its statistics, Zen Money even takes into account SMS from the bank, which notify about various incomes and expenses. In order to record information about the next financial transaction, you do not need access to the Internet.

The developers have made a feature that allows you to import data from a bank account. The app can also remind you of your debts that need to be paid off soon and remember the payments you have scheduled. The interface is clear and convenient, which simplifies working with this option.

Monefy

This app doesn't have the ability to remind you about debts and scheduled payments, but we appreciate it because of certain advantages. You can keep track of multiple accounts in one application as these accounts are divided into different tabs.

For security, the developers have added the ability to access data using a PIN code or fingerprint sensor. The paid version offers charts, reports and SMS recognition from the bank. Management is easy.

Bills Monitor

This application allows you to download information about paid bills. It will help you forecast and plan subsequent expenses. With a color-coded calendar, you'll know which bills you've paid and which debts you still have to pay off.

We know that many people choose this software because it will allow them to make payments from within the application itself. The main disadvantage is the lack of an interface in Russian. You can also keep your information secure by using a PIN code.