Computer technology is used today in every enterprise. Like other fixed assets, it is subject to inventory. This procedure has distinctive features. The procedure for conducting an inventory of property is regulated by: Law on Accounting No. 402-FZ of December 6, 2011, Methodological Recommendations, approved. By Order of the Ministry of Finance No. 49 of June 13, 1995, Regulations on accounting, approved. By Order of the Ministry of Finance No. 34n dated July 29, 1998. Let us consider in detail in the article how computer inventory is carried out and what inspectors need to know about this type of accounting.

Inventory of computers over the network

Currently, there are a large number of special programs that allow you to quickly perform an inventory of computer equipment. To carry out an automated inventory, it is necessary that all the company’s equipment be connected to a single network. The order of further actions is given in the table.

| Control stages | Actions |

| Purchasing the program | Installation on the host computer (server) |

| Launching the application | Enabling the Viewer |

| Polling all network devices | Connecting to the network and preparing information for analysis |

| Data systematization | Generating inventory reports |

The use of an automated program has a number of advantages:

- Possibility of using templates or independently developed reporting forms;

- Background check;

- Time saving;

- No need to separate employees from performing their duties;

- One hundred percent accuracy of the data obtained.

The entire volume of data on computer equipment and software products is subject to verification.

A special feature of a specialized inventory program is that scanning can be scheduled according to a specific schedule. According to the specified scheme, the program will view network data and present final reports. This allows you to find out at the right time what condition the company’s computer equipment is in.

Timing of the inspection

Computers are the company's fixed assets. In accordance with the law, their planned inventory is carried out once every 3 years before filling out the final financial statements. Management can independently determine the timing and frequency of inspections and reflect this in the accounting policies.

Carrying out an inventory is mandatory for the following reasons:

- Change of responsible employees;

- Identification of cases of theft and damage to property;

- Liquidation of a company or its reorganization;

- Emergencies and natural disasters;

- In other cases established by law (clauses 1.5, 1.6 of the Recommendations, approved by Order No. 49).

Why do you need an inventory?

The purpose of the inventory is to check and document the presence, condition and assessment of the property of the enterprise.

The legislation obliges organizations to conduct an inventory in the following cases (clauses 26–27 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance dated July 29, 1998 No. 34n):

- upon disposal of property (rental, redemption, sale);

- on the eve of the annual financial statements;

- when changing financially responsible persons;

- when facts of theft, abuse or damage to property are revealed;

- in the event of a natural disaster, fire or other emergency situations caused by extreme conditions;

- during reorganization or liquidation of the organization.

You will learn how to conduct an annual inventory from the ready-made solution “ConsultantPlus”. If you don't already have access to the system, get a free trial online.

An inventory of fixed assets can be carried out once every three years. You will find more information on the topic in our other article.

An organization can fulfill the obligation to conduct an inventory in two ways:

- the usual and proven manual method, when the audit commission makes a tour and recalculates the property, entering data directly into the inventory sheet;

- using specialized programs for inventory, when part of the process is carried out automatically, which greatly simplifies the procedure and saves time.

The procedure for conducting computer accounting

Before starting inventory activities, preparatory activities need to be carried out. To simplify the procedure, a label should be attached to each object. It displays the following information:

- Name of the enterprise;

- Name of the object according to accounting data;

- Inventory number;

- Responsible officer.

The order of the inventory is reflected in the table:

| No. | Stage | Actions |

| 1 | Preparatory | Appointment of a commission, drawing up an inspection plan, issuing an order, printing inventory records |

| 2 | Examination | Inspection of objects by divisions of the organization in the context of financially responsible persons, filling out inventories |

| 3 | Recording discrepancies | Documentation of surpluses or shortages (memos, inventories) indicating the reasons for the discrepancies |

| 4 | Registration of results | Drawing up an act |

| 5 | Data Mapping | Reconciliation of received data with registration data |

The order can be drawn up in the INV-22 form or in a free form. The document indicates the reason for the inspection, the composition of the commission, the start and end dates, and what property is being inventoried. Data during the inspection are recorded in inventory records (form INV-1, INV-1a for intangible assets).

The information in them is grouped by responsible employees and structural divisions. They contain accounting information about the nomenclature, quantity and inventory numbers of inspection objects. During the inspection of the equipment, the commission enters similar actual data into the inventory.

If faulty equipment or its absence is identified, a report is drawn up addressed to the director. The names and numbers of equipment lost or unsuitable for further use are recorded in it. The reasons for the identified defects are also indicated here, and the signature of the employee responsible for the safety of valuables and members of the commission are signed. The identified surpluses are processed in the same way.

Based on these inventories, the commission draws up a report on the results of the control. The final stage is the reconciliation of the information received with accounting data. The necessary adjustments are made, the culprits are punished, etc.

Example. In October 2020, during an inventory at Udacha LLC, it turned out that a computer purchased in July last year was in use. He was not taken into account. The cost of the object is 50,150 rubles, including VAT - 7,650 rubles.

The computer must be registered and depreciation must be calculated for the entire period of its operation. The service life is determined to be 30 months. Depreciation is calculated using the straight-line method.

1/30 * 100 = 3.33% - depreciation rate;

(50,150 – 7,650) * 3.33% = 1,415.25 rub. - amount of depreciation per month.

In October 2020, the accountant made the following entries:

Dt 08 Kt 60 50 150 rub. — the computer has been registered;

Dt 19.1 Kt 60 7,650 rub. — VAT on the purchased object is taken into account;

Dt 01 Kt 08 50 150 RUR — the computer is included in fixed assets;

Dt 91.2 Kt 02 7,076.25 rub. — depreciation for 2020 is reflected (1,415.25 * 5);

Dt 26 Kt 02 14 152.50 rub. — the amount of depreciation for the current year at the time the error was discovered was taken into account (1,415.25 * 10).

Carrying out an inventory

Now it is necessary to analyze in more detail the inventory process, as well as its regulatory registration at the enterprise (organization).

Scope of work

Each inventory, depending on the purpose of its implementation, has one or another content. The scope of work that will have to be carried out at this particular time is determined by the head of the organization on whose balance sheet the computers are located. The list of works may include the following:

- recalculation of equipment units;

- reconciliation of inventory numbers;

- reconciliation of the registered locations of this or that equipment in the organization’s offices;

- analysis of the need to write off this or that equipment due to old age and obsolescence;

- checking the quality of the computer operating system;

- analysis of the efficiency of using ink on cartridges for printing;

- checking computers using special programs or over a network.

Decree and order

To carry out an inventory at an enterprise, an order is issued from the head of the organization. The main details of this order are as follows:

- the name of the legal entity is indicated at the top;

- The word “Order” is written just below;

- on the next line on the left is the date of registration of the document, and on the right is its number;

- on the next line the name of the city in whose territory this legal entity is located is written;

- The name of the order is written below. Most often these are the words “About carrying out an inventory”;

- the preamble indicates the main regulations that govern the inspection process, as well as the main purpose of scheduled or unscheduled control;

- point No. 1 - statement of the need to organize an inventory of computer equipment or other property as of a certain date;

- paragraph 2 of the order usually specifies the composition of the commission members;

- it is also necessary to register a list of financially responsible persons who are also required to take part in control actions;

- the timing and procedure for recording the results of the inspection.

Rules

The basic rules for conducting an inventory are:

- strict adherence to the norms of regulatory acts;

- conducting a detailed inspection of all objects that are specified in the order and are on the balance sheet;

- presence of all members of the inventory commission during the inspection.

If at least one member of the commission is absent, the results of the inspection may be invalidated.

Stages

The main stages of the audit are as follows:

- Preparation. The main elements of this stage:

- preparation of an order;

- determining the purpose and subject of the inventory;

- determining the composition of the commission to conduct the inspection;

- planning the date of the event;

- actions to carry out. As part of this stage, physical actions will be carried out to recalculate and check the availability of inventory items. In addition, as you know, licensed programs are installed on computers, which are also purchased with company money. This is why it is logical to use special software inventory methods:

- using the program;

- over local network.

Taking inventory using the program can help you check:

- correct accounting of computers and other office equipment at the enterprise;

- completeness of PC software using special scanning of all systems;

- check the speed of your computer;

- track the use of all important programs that are necessary for the work of employees;

- check geodata and many other functions.

Computer inventory is also carried out on the network using special programs, the technical capabilities of which allow:

- keep records of all equipment located at the enterprise;

- analyze the presence and operation of software on all PCs;

- check the system for outside intrusion.

The last stage of computer inventory is drawing up an inventory report, which must be signed by all members of the commission.

Automated inventory program

With an automated inventory method, labels with a bar code are printed from a computer accounting database for each object. Subsequently, they are glued to the appropriate equipment. When coding in this way, the 1C “Equipment Accounting” program is used for inventory. You can download its demo version on the Internet and watch the presentation.

Computers are checked using barcode scanning by the well-known Hardware Inspector program.

All specialized programs on the market have a similar operating procedure. For example, it is easy to download and use the product “Inventory of computers on the network.” It allows you to detect outdated models, schedule equipment updates, select computers whose resources do not correspond to the tasks performed on them, etc.

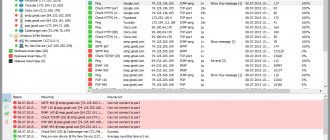

The IT Invent program has proven itself well. It supports network scanning and collects information on all network devices. With its help, you can carry out inventory accounting of network computers in all branches of the company.

The free version contains a limited set of functions; their full list is available in the commercial version of the product. Another program, “10-Strike: Computer Inventory,” is offered in several modifications.

An organization can choose one that is more suitable for its purposes.

Is it possible to carry out an inventory in 1C

If we are talking about a standard program, for example, “1C: Accounting 8.3”, then it can only reflect the results of a manual inventory, generate an inventory list, an order to carry out an inventory and a matching sheet.

It is also possible to carry out an inventory in 1C-Retail. It provides for the recalculation of goods, their posting and write-off.

For the convenience of users, the product “1C-Inventory and Property Management” was created. The program completely covers the organization's inventory needs and greatly simplifies its implementation. The current edition provides for the use of modern means of automatic identification (barcoding) and allows you to solve a lot of issues relating to company property and its accounting.

Accounting entries for accounting for surpluses and shortages

To reflect inventory results in accounting, the following standard operations are provided:

Accounting for surplus:

Dt 08.3 Kt 91.1 - income in the form of fixed assets is taken into account;

Dt 01 Kt 08 - the object is accepted for accounting at the market price.

Dt 91.1 Kt 99 - profit from accepting an unaccounted object for accounting is reflected.

Accounting for shortages:

If the culprit is not found, the damage is reflected as follows:

Dt 94 Kt 01 - shortage detected;

Dt 02 Kt 01 - depreciation of the missing object is written off;

Dt 91.2 Kt 94 - the loss is charged to other expenses.

If the culprit is found, then the operations look like:

Dt 73 Kt 94 - the shortage is written off to the culprit;

Dt 50 Kt 73 - the employee repaid the debt;

Dt 70 Kt 73 - the debt is withheld from the employee’s earnings.