The meaning and functionality of the mobile application

MTS mobile bank is designed for those clients who value their time, want to manage their finances and receive the necessary information instantly.

Using the application, you can make transactions yourself, without contacting a bank branch around the clock:

- process transfers to cards and accounts of other MTS clients and third-party organizations;

- replenish deposits and accounts;

- repay in full, in part or make monthly payments on loans;

- create auto payments to pay for fixed expenses - telephone, Internet, television, etc.;

- create applications for blocking and unblocking cards if necessary;

- send transfers using the card number of any payment system;

- pay utility bills, fines, tax payments;

- replenish electronic wallets;

- pay for goods in online stores;

- find out information about promotions and bank news;

- detail and manage expenses;

- monitor exchange rates;

- quickly find a bank branch or ATM if necessary.

Free MTS Bank application - opportunities

Clients who have installed a mobile remote service can use all the opportunities provided by standard Internet banking.

A significant advantage of the version for smartphones is that you don’t need a desktop computer or laptop to activate services, you just need to download and install the application, and it requires the Internet to work. Access is free.

After installing the MTS Bank Application, the client gets the opportunity to:

- Monitor the status of your accounts in real time;

- Receive information about the loan balance, the amount and the nearest payment date, as well as pay the next installment;

- Send money to other cardholders of both MTS Bank and other financial organizations (using details or card number);

- Open and close deposits, savings accounts;

- Block cards and reactivate them;

- Make payments to any organization for any services - housing and communal services, television, Internet, insurance, buying tickets, ordering goods;

- Transfer money to electronic wallets, including a special MTS Money wallet;

- Pay taxes, fines and fees, as well as state duties;

- Saving and using templates for performing frequently repeated transactions, as well as setting up automatic payments;

- Purchasing currency at the MTS Bank rate, opening deposits in foreign currency.

According to customer reviews, the average rating for the application is 3. However, MTS Bank is constantly improving and updating its remote service.

After installing the program on Android or any other mobile platform, the client will begin to receive information about MTS Bank news and promotions in real time with the ability to filter messages.

Additional options available only for the mobile application:

- Prompt communication with bank employees to resolve complex situations or obtain advice on individual products;

- Search using GPS for the nearest ATMs or MTS Bank branches;

- Control of expenses and income with the possibility of receiving an extended account statement;

- Obtaining information about exchange rates.

Advantages of mobile banking

- Service security ensured by the transfer of information via special communication channels.

- Convenient and simple interface.

- Designed for all operating systems Windows Phone, Android, iOS and allows clients to work with it from all mobile devices.

- A large list of operations available for independent execution.

- 24/7 access to information.

- Ability to manage money.

- Favorable offers on exchange rates and promotions for customers.

- Making transfers without commissions between Bank clients.

- Free service support.

- Simple connection algorithm.

- Increased interest on deposits opened online.

- Possibility of full and partial repayment of the loan at a convenient time.

Installing MTS Bank on mobile devices

You can install the MTS Bank application on smartphones running Android, iOS, Windows Phone, as well as on equipment with Java support.

On Android

You can download MTS Bank for Android from the official store for the operating system or via APK.

Google Play

Instructions:

- Follow the link or open the Play Market and find the application through the search bar.

- Click “Install”.

- Wait for the download and subsequent installation to complete.

After downloading and installing, you need to click on the shortcut on your desktop and begin registering with the service.

APK

If the client has any difficulties downloading the application from Google Play, he can install it from the APK file. You can download it by clicking the button below.

Installation from APK is a good way to download and install the old version of the MTS Bank application. This may be required if the new version of the service is not suitable for the user for some reason. First you need to find the required distribution version on the network and download it to your computer or directly to your smartphone’s memory.

Installation instructions:

Natalia

Technical specialist, user support on mobile communications issues.

Ask a Question

If you find an error or inaccuracy on the site, please write in the comments or feedback form. I recommend checking out:

Secret tariffs from MTS The most profitable List of unlimited ones Check where the money goes Order details

- Download the installation file and move it to the memory of your mobile device if the download was performed on a computer.

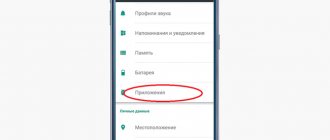

- Open your smartphone’s settings, find the “Security” section and allow installation from unknown sources in it.

- Go to the gadget's memory, find the APK file and click on it to start the installation.

- Confirm action.

- Wait for the installation to complete.

After the process is completed, the application shortcut will appear on the desktop of the smartphone.

On iOS

Installation instructions on iPhone:

- Follow the link or find “MTS Bank” through the search bar in the App Store.

- Click "Get".

- Enter your Apple ID password to confirm installation.

Next, you just have to wait for the download and installation to complete.

On Windows Phone

To install the application on mobile devices running Windows Phone, you need to follow the link and click “Get”, and then, after downloading, click “Install”. After this, you should wait until the installation is completed, after which you can start using the service.

In Java

To install the application on equipment with Java support, you need to download the appropriate version of the distribution from the Jar and Jad links, click on it and follow the further instructions of the installation wizard.

Application connection

If you have already contacted MTS Bank, you can connect the mobile version at any ATM or by visiting a branch and asking a specialist for help.

If you were not a client of MTS Bank, then you need to apply for any product, for example, an MTS Money debit card, and immediately receive a login and password for access. When the card is activated, you will receive an SMS with a digital signature A-PIN (several numbers that will need to be used to confirm all operations).

After which you need to download the application from the official website via the link www.mts-banker.ru.

While working, you may need to remember your login or password; to do this, you can contact technical support by calling 8-800-250-520.

Login to your personal account

Tariffs and conditions for free communication

The current tariffs of MTS Smart Money credit and debit cards are presented in the table:

| Credit | Debit | |

| Release | 199 rub. | |

| Payment system type | MasterCard | |

| Credit rate | Absent | 24,9-27% |

| Grace period | Not provided | 51 days |

| Mobile banking via messaging | For free | |

| Currency of registration | Ruble | |

| Possibility of producing an additional card | Absent | |

| Maximum cash withdrawal amount per day | 50,000 rub. | |

The monthly service fee is 99 rubles. It does not apply to holders using MTS tariff plans.

Additionally, you can get free communication on the tariff if the user regularly pays for goods, services with a card or uses a savings account.

The conditions for receiving free communication are presented in the table:

| Conditions | Tariff plan | ||

| “Smart”, “MTS tablet”, “Smart Unlimited”, “Tariff X”, “My Unlimited”, “My Smart” | “Smart Non Stop”, “Smart Unlimited+”, “Tariffishche” | “Smart+”, “Smart Zabugorishche”, “Our Smart” | |

| Amount of monthly expenses, rub. | 10 000 | 20 000 | 30 000 |

| Constant balance, rub. | 50 000 | 70 000 | 100 000 |

When requirements are not met, fees will be charged according to the tariff.

Transferring money and topping up your account

In order to make a translation you need:

- Open a mobile bank on your phone or tablet.

Mobile bank menu

- Indicate the cards or phone number from which the transfer will be made.

- Enter information about the payee.

- Click the “Pay” button.

- To confirm the operation, enter the A-PIN code.

Example of a menu for replenishing a card

To replenish an MTS Bank card from debit or credit cards of other banks, you need to go to the “Transfers” menu item and select replenishment by card number.Example of a transfer from a bank card

Loan repayment in the MTS Bank account

In the “Loans” menu section, bank clients can view information about current credit debt and repay it by debiting money from their account. It is also possible to repay loans from other banks via bank transfer in your personal account.

Important! Money can be credited to accounts in other banks within 3 business days.

Payment for goods and services

When shopping online at some companies, you must make payment before receiving the order or transfer an advance payment.

In order to make a payment, you need to select the card from which you want to transfer money and, through the “Pay with card” menu, carry out the operation, selecting the recipient of the money from the proposed partners, or enter the details by creating a payment order.

Menu for paying for goods and services

Payment for services in your MTS Bank personal account

Why visit branches to pay for various payments and services, if you can do this in any convenient place in a few clicks. Go to the “Pay” section in your personal account. Select the type of service: replenish your mobile balance, pay for the Internet, housing and communal services, communication services, etc.

Important! Check the correctness of the service provider and personal data: phone number, account, apartment, etc.

Specify the account from which you want to debit the money and confirm the payment.